Indecon February 2021

- Raghav Sand

- Feb 12, 2021

- 3 min read

Updated: Nov 21, 2022

Indian economy is in the limelight for the past fortnight. Ministry of Finance delivered the Economic Survey and Union Budget for financial year 2020-21 and 2021-22, respectively. Economic Survey advised the Government to spend big on infrastructure and the budget duly complied. The economy is getting back on its feet steadily and the prospects for next fiscal are bright.

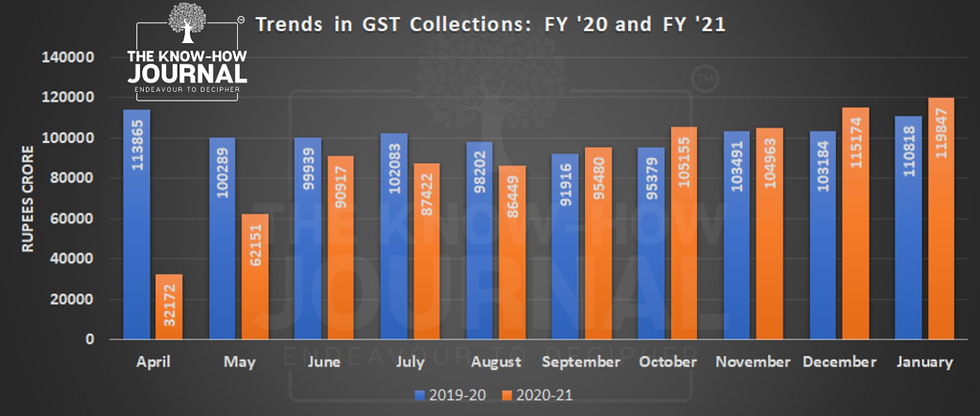

GST Collection January 2021

The gross GST revenue collected in the month of January 2021 was ₹1,19,847 crores. The total number of GSTR-3B Returns filed for the month of December up to 31st January 2021 was 90 lakhs. The government settled ₹24,531 crore to CGST and ₹19,371 crore to SGST from IGST as regular settlement. The total revenue earned by Central Government and the State Governments after regular settlement in the month of January 2021 was ₹46,454 crore for CGST and ₹48,385 crore for the SGST.

In line with the trend of recovery in the GST revenues over past five months, the revenues for the month of January 2021 were 8% higher than the GST revenues in the same month last year, which in itself was more than ₹1.1 lakh crore. In January, revenue from import of goods was 16% higher and the revenue from domestic transaction (including import of services) was 6% higher than the revenues from these sources during the same month last year.

The GST revenues during January 2021 are the highest since introduction of GST and has almost touched the ₹1.2 lakh crore mark, exceeding the last month’s record collection of ₹1.15 lakh crore. GST revenues above ₹1 lakh crore for a stretch of last four months and a steep increasing trend over this period are clear indicators of rapid economic recovery post pandemic.

Closer monitoring against fake-billing, deep data analytics using data from multiple sources including GST, Income-tax and Customs IT systems and effective tax administration have also contributed to the steady increase in tax revenue over last few months.

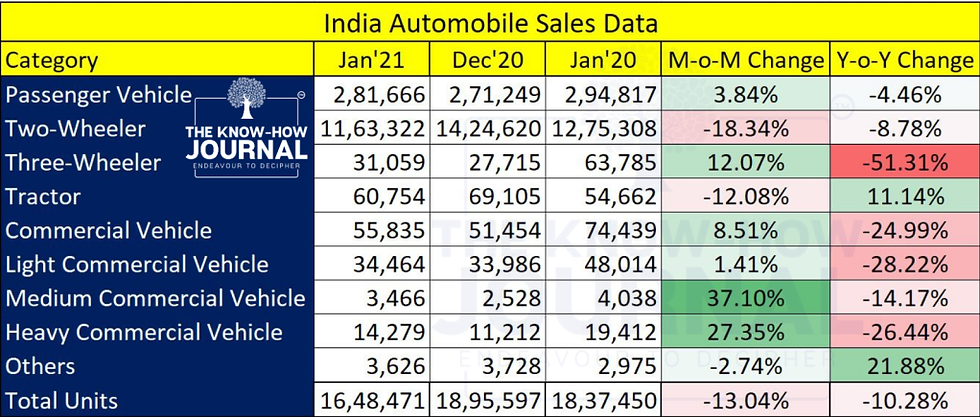

Automobile Sector

January 2021 vehicle registrations fell by 10.28%, according to the latest data released by the Federation of Automobile Dealers Associations (FADA). Non-availability of vehicles due to scarcity of semiconductors, a declining demand and recent price hikes were the primary reasons for the decline. The three-wheeler segment registered sharpest decline when compared with sales data of last year. Tractor sales have been holding ground and an annual increase of 11.14% is a positive sign.

After the festive euphoria of Oct-Nov 2020, vehicle sales are falling steadily. Revival of demand is vital for the sector as a whole. On annual basis, fewer commercial vehicles got registered in January 2020, while the same segment brought some cheers for the industry on monthly basis. The Government announced a vehicle scrappage policy in the budget and the automobile industry expects it to be a game changer; a detailed policy document is in the works.

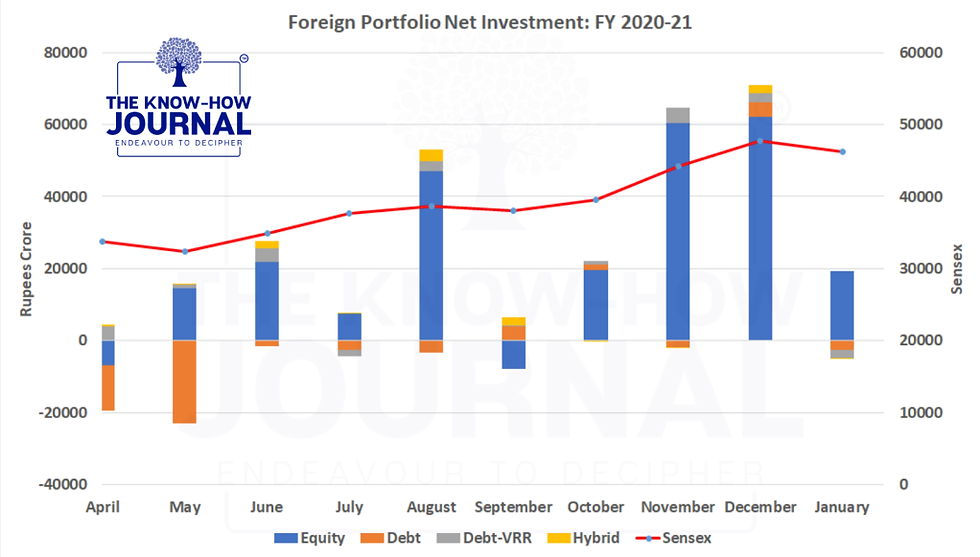

FPI and Sensex

After net investment of ₹1,55,655 crores in the last three months of 2020, Foreign Portfolio Investment cooled down in January 2021. The Indian stock markets reached all-time high as the BSE Sensex scaled 50,000 mark on January 21, 2021. Benchmark indices have almost doubled in the last 12 months. After the regime change in United States and consistent inflows in the second half 2020, FPI’s have reassessed portfolio allocation.

Purchasing Manager’s Index

In response to faster expansions in total sales and new export orders, Indian manufacturers scaled up production at the quickest pace in three months. Input costs rose and supply chain constraints lingered. The seasonally adjusted India Manufacturing Purchasing Managers’ Index rose from 56.4 in December to 57.7 in January.

The Services Business Activity Index rose from 52.3 in December to 52.8 in January, pointing to a quicker expansion in output. Still, the headline figure remained below its long-run average of 53.3 and was consistent with a moderate pace of growth. Companies that reported higher business activity commented on greater client numbers and improved demand conditions.

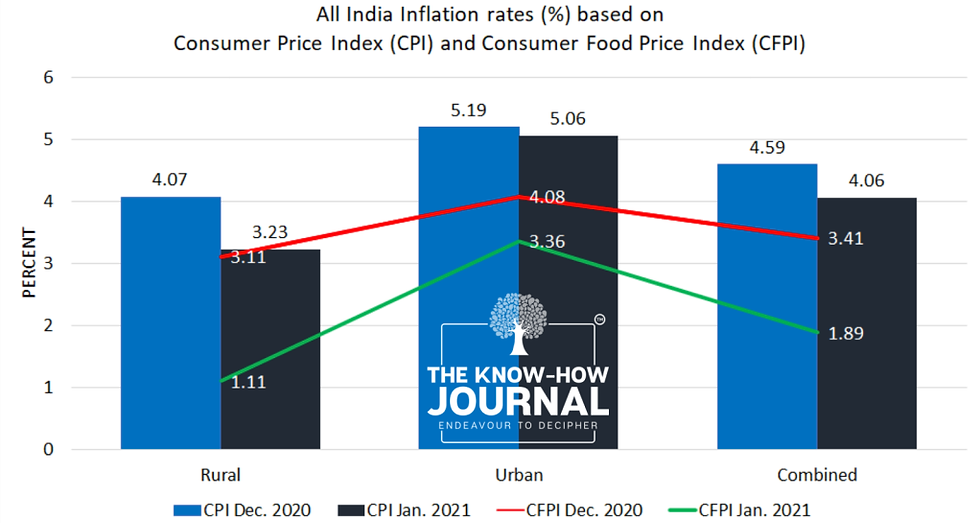

Inflation

All India Consumer Price Index (CPI) for the month of January 2021 was 4.06 percent (provisional). There has been a steady decline in inflation during winter and CPI for the past couple of months is with in the Reserve Bank of India’s tolerance range. Consumer Food Price Index (CFPI) registered steep correction in January 2021 and settled at 1.89 percent vis-à-vis 3.41 percent in December 2020.

The Final Word

The Economic Survey and Union Budget have focused on increased spending by the Government. The near term dent on the fiscal deficit should help in reviving the economy. India can no longer afford to be content with suboptimal growth and the demographic advantage needs to be monetized for common good.

Comments